- Welcome to Capital Alligator Forum.

Recent posts

#71

Strategies / LEAPS

Last post by Dexter - May 26, 2016, 09:57:42 PMHas anyone successfully employed a LEAPS (Long-Term Equity Anticipation Securities) strategy? If so, I'd be interested to hear what you did. My results to date with LEAPS have been mixed. But if LEAPS are used judiciously, they can be an excellent source of leverage -- just ask the guys at Cornwall Capital.

#72

Investment Ideas / Re: TWTR - Twitter Inc.

Last post by Dexter - May 25, 2016, 01:43:26 PMThe BBC posted this interview today with Jack Dorsey, Twitter's CEO.

http://www.bbc.com/news/technology-36376037

http://www.bbc.com/news/technology-36376037

#73

Books / "The Outsiders" by William Tho...

Last post by Dexter - May 24, 2016, 08:03:40 PMI just started re-reading William Thorndike's fantastic book entitled "The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success." The book profiles eight CEOs who excelled at capital allocation and obtained shareholder returns that blew away their industry peers and the S&P 500.

If you get the chance, you should pick up a copy and give it a read -- it will be well worth your time.

If you get the chance, you should pick up a copy and give it a read -- it will be well worth your time.

#74

Investment Ideas / Re: TWTR - Twitter Inc.

Last post by Dexter - May 24, 2016, 12:55:09 PMLooks like TWTR shares are down today due to some analyst downgrades and comments.

http://www.marketwatch.com/story/twitters-stock-tumbles-toward-record-low-after-downbeat-analyst-comments-2016-05-24

http://blogs.barrons.com/techtraderdaily/2016/05/24/twitter-has-failed-says-moffettnathanson-no-compelling-reason-to-own-the-stock/?mod=yahoobarrons&ru=yahoo

http://www.marketwatch.com/story/twitters-stock-tumbles-toward-record-low-after-downbeat-analyst-comments-2016-05-24

http://blogs.barrons.com/techtraderdaily/2016/05/24/twitter-has-failed-says-moffettnathanson-no-compelling-reason-to-own-the-stock/?mod=yahoobarrons&ru=yahoo

#75

Capital Allocators / Re: Thomas Gayner

Last post by Dexter - May 23, 2016, 07:37:08 PMHere's a talk that Tom Gayner gave at Google. It's excellent.

https://www.youtube.com/watch?v=2sG91e1Wh4I

https://www.youtube.com/watch?v=2sG91e1Wh4I

#76

General Discussion / 'How the Economic Machine Work...

Last post by Dexter - May 21, 2016, 07:03:09 PMI ran across this YouTube video the other day by Ray Dalio (founder of Bridgewater Associates) and wanted to share it with the board. The video discusses economic concepts like credit, deficits and interest rates. It's very informative.

https://www.youtube.com/watch?v=PHe0bXAIuk0

https://www.youtube.com/watch?v=PHe0bXAIuk0

#77

Investment Ideas / Re: TWTR - Twitter Inc.

Last post by Dexter - May 19, 2016, 04:17:53 PMHey Mark,

No problem -- I've enjoyed looking into Twitter's business.

I'm still researching the company and formulating my opinion on Twitter's future prospects.

I can see two potential paths to profits for the company:

1) Grow Monthly Active Users (MAUs), revenues and profits.

2) Try to maintain the number of MAUs they currently have and reduce costs.

If Twitter is able to increase it's number of MAUs, that would probably be the best outcome for them. By increasing MAUs, the Twitter network would become more valuable and revenues would probably increase more than costs (due to network effects and economies of scale). This should lead to profits. However, Twitter has had a hard time increasing MAUs in the last 4 quarters and I'm not entirely sure why. Are people tired of Twitter and their offerings, or is something else going on? I don't know.

If Twitter reduces costs (for example, R&D) and tries to milk the value of its network, the network might start to shrink and lose value. However, if some of its current spending consists of growth capital expenditures (capex), then maybe some costs can be eliminated without harming the number of MAUs. I do wonder, though, what will happen to Twitter if it's not the top dog in messaging in the future.

So, here are a few questions for you:

1) Why do you think growth has slowed?

2) Do you think this slowdown is temporary? If so, why?

3) Are there any good substitutes for Twitter?

I'm interested to hear your thoughts.

No problem -- I've enjoyed looking into Twitter's business.

I'm still researching the company and formulating my opinion on Twitter's future prospects.

I can see two potential paths to profits for the company:

1) Grow Monthly Active Users (MAUs), revenues and profits.

2) Try to maintain the number of MAUs they currently have and reduce costs.

If Twitter is able to increase it's number of MAUs, that would probably be the best outcome for them. By increasing MAUs, the Twitter network would become more valuable and revenues would probably increase more than costs (due to network effects and economies of scale). This should lead to profits. However, Twitter has had a hard time increasing MAUs in the last 4 quarters and I'm not entirely sure why. Are people tired of Twitter and their offerings, or is something else going on? I don't know.

If Twitter reduces costs (for example, R&D) and tries to milk the value of its network, the network might start to shrink and lose value. However, if some of its current spending consists of growth capital expenditures (capex), then maybe some costs can be eliminated without harming the number of MAUs. I do wonder, though, what will happen to Twitter if it's not the top dog in messaging in the future.

So, here are a few questions for you:

1) Why do you think growth has slowed?

2) Do you think this slowdown is temporary? If so, why?

3) Are there any good substitutes for Twitter?

I'm interested to hear your thoughts.

#78

Investment Ideas / Re: TWTR - Twitter Inc.

Last post by Mark P. - May 18, 2016, 11:30:36 PMMatt,

Thanks for your thoughts up to this point. Based on your analysis and research thus far what is your overall opinion on Twitter as a company and their future prospects in increasing revenues, and ultimately making profits.

Thanks,

Mark P.

Thanks for your thoughts up to this point. Based on your analysis and research thus far what is your overall opinion on Twitter as a company and their future prospects in increasing revenues, and ultimately making profits.

Thanks,

Mark P.

#79

Capital Allocators / Thomas Gayner

Last post by Dexter - May 18, 2016, 10:33:12 PMThought I'd kick off this category with an excellent investor and capital allocator: Thomas Gayner, co-Chief Executive Officer of Markel Corp.

Recently, Tom gave an excellent interview to Value Investor Insight (VII), and I thought I would share it with the group. Here's a link to the interview:

http://www.valueinvestorinsight.com/pdfs/TrialAPR2016.PDF

In this interview Tom described his investment process, as follows: "We're looking for profitable businesses with good returns on capital at modest leverage, that have honest and talented management, that have reinvestment opportunities and capital discipline, and that have shares trading at fair prices."

Tom also provided some commentary on The Walt Disney Company, Brookfield Asset Management, Diageo, and Nestle in this VII interview.

I found one passage of the interview especially interesting. In it, Tom Gayner said: "We were buyers...and at the end of the year owned core positions in Alphabet, Amazon and Facebook. Ten years ago I wouldn't have owned any of them, but given the winner-take-all elements of their businesses you can credibly think about how durable the franchises are and how much runway they have ahead. At the end of last year Alphabet had $73 billion of cash on its balance sheet. People say, 'Oh, but a lot of that is trapped overseas,' to which I say, so what? It's $73 billion! This is an immense cash-generating machine at the top of the food chain in the world of data, which as everything becomes more and more digital becomes more and more valuable over time. I'd also add that each of these companies has young, founder visionaries who have already demonstrated remarkable success. That fits very well with how we invest."

Tom Gayner's change in attitude regarding tech companies is pretty incredible. Most value investors claim that they can't invest in tech because of the constant change, brutal competition, and disruption inherent in the industry. But here is a stalwart value investor stating that he is now willing to own certain technology companies (whereas 10 years ago, he wouldn't have). Certainly food for thought.

Recently, Tom gave an excellent interview to Value Investor Insight (VII), and I thought I would share it with the group. Here's a link to the interview:

http://www.valueinvestorinsight.com/pdfs/TrialAPR2016.PDF

In this interview Tom described his investment process, as follows: "We're looking for profitable businesses with good returns on capital at modest leverage, that have honest and talented management, that have reinvestment opportunities and capital discipline, and that have shares trading at fair prices."

Tom also provided some commentary on The Walt Disney Company, Brookfield Asset Management, Diageo, and Nestle in this VII interview.

I found one passage of the interview especially interesting. In it, Tom Gayner said: "We were buyers...and at the end of the year owned core positions in Alphabet, Amazon and Facebook. Ten years ago I wouldn't have owned any of them, but given the winner-take-all elements of their businesses you can credibly think about how durable the franchises are and how much runway they have ahead. At the end of last year Alphabet had $73 billion of cash on its balance sheet. People say, 'Oh, but a lot of that is trapped overseas,' to which I say, so what? It's $73 billion! This is an immense cash-generating machine at the top of the food chain in the world of data, which as everything becomes more and more digital becomes more and more valuable over time. I'd also add that each of these companies has young, founder visionaries who have already demonstrated remarkable success. That fits very well with how we invest."

Tom Gayner's change in attitude regarding tech companies is pretty incredible. Most value investors claim that they can't invest in tech because of the constant change, brutal competition, and disruption inherent in the industry. But here is a stalwart value investor stating that he is now willing to own certain technology companies (whereas 10 years ago, he wouldn't have). Certainly food for thought.

#80

Investment Ideas / Re: TWTR - Twitter Inc.

Last post by Dexter - May 18, 2016, 02:12:55 AMContinuing on...

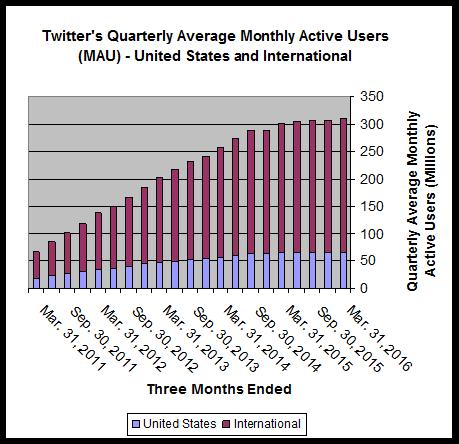

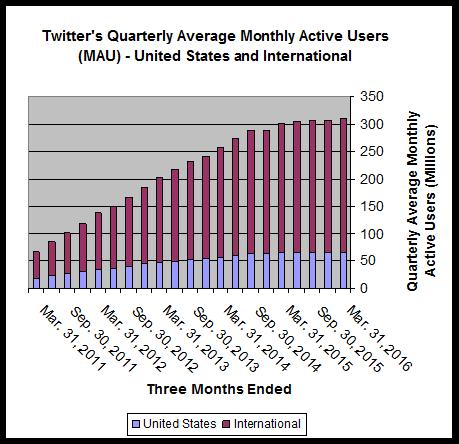

Twitter's growth in Quarterly Average Worldwide Monthly Active Users (MAUs) has been anemic for the last 4 quarters, as shown below.

(For your reference, International MAUs plus United States MAUs are equal to Worldwide MAUs.)

For the quarter ended March31, 2015, Twitter had an average of 302 million Worldwide MAUs, and for the quarter ended March 31, 2016, average Worldwide MAUs had only increased to 310 million -- a quarterly average growth rate of about 0.7%. However, for the quarters ending June 30, 2011 through March 31, 2013, every quarter except one had double digit growth in average Worldwide MAUs (and the one quarter that didn't have double digit growth had 9.4% growth). Thus, Twitter's MAU growth has slowed significantly in the last few years.

Since 2011, 72% or more of Twitter's user base has been International. For the quarter ended March 31, 2011, 72% of Twitter's quarterly average Worldwide MAUs were located Internationally and 28% were located in the United States. For the quarter ended March 31, 2016, 79% of Twitter's quarterly average Worldwide MAUs were located Internationally and 21% were located in the United States.

After examining the numbers, it becomes clear that the majority of Twitter's growth in MAUs has come from outside the United States.

Twitter's growth in Quarterly Average Worldwide Monthly Active Users (MAUs) has been anemic for the last 4 quarters, as shown below.

(For your reference, International MAUs plus United States MAUs are equal to Worldwide MAUs.)

For the quarter ended March31, 2015, Twitter had an average of 302 million Worldwide MAUs, and for the quarter ended March 31, 2016, average Worldwide MAUs had only increased to 310 million -- a quarterly average growth rate of about 0.7%. However, for the quarters ending June 30, 2011 through March 31, 2013, every quarter except one had double digit growth in average Worldwide MAUs (and the one quarter that didn't have double digit growth had 9.4% growth). Thus, Twitter's MAU growth has slowed significantly in the last few years.

Since 2011, 72% or more of Twitter's user base has been International. For the quarter ended March 31, 2011, 72% of Twitter's quarterly average Worldwide MAUs were located Internationally and 28% were located in the United States. For the quarter ended March 31, 2016, 79% of Twitter's quarterly average Worldwide MAUs were located Internationally and 21% were located in the United States.

After examining the numbers, it becomes clear that the majority of Twitter's growth in MAUs has come from outside the United States.