- Welcome to Capital Alligator Forum.

Recent posts

#81

General Discussion / 401k's vs IRA's

Last post by Dexter - May 16, 2016, 11:05:56 PMFound some good articles/resources on 401k's versus IRA's and wanted to share them with the board. Enjoy.

https://investor.vanguard.com/ira/401k-vs-ira

https://www.betterment.com/resources/retirement/401ks-and-iras/can-you-have-a-401k-and-an-ira/

https://www.irs.gov/Retirement-Plans/Roth-Comparison-Chart

https://investor.vanguard.com/ira/401k-vs-ira

https://www.betterment.com/resources/retirement/401ks-and-iras/can-you-have-a-401k-and-an-ira/

https://www.irs.gov/Retirement-Plans/Roth-Comparison-Chart

#82

Investment Ideas / Re: TWTR - Twitter Inc.

Last post by Dexter - May 13, 2016, 01:05:21 PMOK, so I'm just going to start parceling out the pieces of my analysis as I complete them.

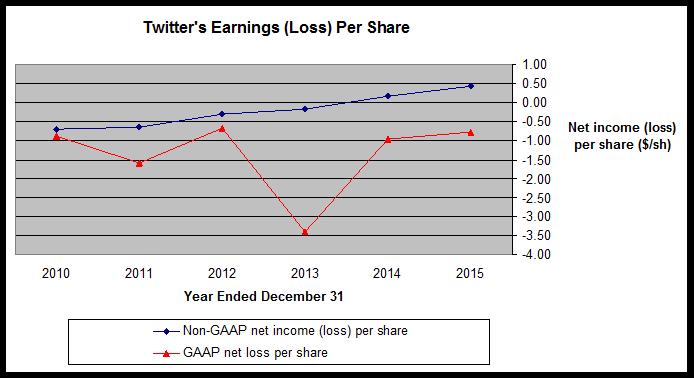

Let's start with TWTR's annual earnings (loss) per share. See graph below.

As you can see, on an annual basis and using Generally Accepted Accounting Principles (GAAP), Twitter has lost money every year since 2010.

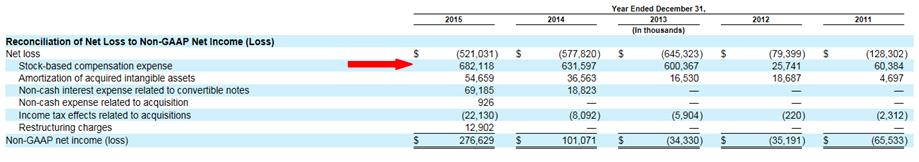

Twitter also provides non-GAAP net income/loss data. Using this non-GAAP measure of earnings, Twitter shareholders actually made money in 2014 and 2015. But the devil here is in the details. As shown below, the reconciliation between Net Loss and the Non-GAAP Net Income (Loss) added back $631 million in 2014 and $682 million in 2015 for stock-based compensation expense. Without these additions, the 2014 and 2015 numbers would have been negative as well. Furthermore, the 2013 non-GAAP net loss would have looked much worse.

While stock-based compensation expenses are not cash outflows for the company (and the exact amount of these expense are based on a number of assumptions), these expenses are real. Just ask existing shareholders who get diluted when new shares come online. Now, that's not to say that Twitter shouldn't issue stock-based compensation -- just that this expense is real and the company needs to obtain enough value in return to justify the expense and avoid harming existing shareholders.

A look at the quarterly numbers between March 31, 2012 and March 31, 2016 shows:

Interestingly, Twitter completed it's initial public offering in November 2013 -- and every quarter thereafter, it reported a non-GAAP net income.

Let's start with TWTR's annual earnings (loss) per share. See graph below.

As you can see, on an annual basis and using Generally Accepted Accounting Principles (GAAP), Twitter has lost money every year since 2010.

Twitter also provides non-GAAP net income/loss data. Using this non-GAAP measure of earnings, Twitter shareholders actually made money in 2014 and 2015. But the devil here is in the details. As shown below, the reconciliation between Net Loss and the Non-GAAP Net Income (Loss) added back $631 million in 2014 and $682 million in 2015 for stock-based compensation expense. Without these additions, the 2014 and 2015 numbers would have been negative as well. Furthermore, the 2013 non-GAAP net loss would have looked much worse.

While stock-based compensation expenses are not cash outflows for the company (and the exact amount of these expense are based on a number of assumptions), these expenses are real. Just ask existing shareholders who get diluted when new shares come online. Now, that's not to say that Twitter shouldn't issue stock-based compensation -- just that this expense is real and the company needs to obtain enough value in return to justify the expense and avoid harming existing shareholders.

A look at the quarterly numbers between March 31, 2012 and March 31, 2016 shows:

- Twitter has lost money in every quarter on a GAAP basis (quarterly losses per share range between $0.07 and $1.41), and

- Twitter lost money on a non-GAAP basis from March 31, 2012 to September 30, 2013, and made money from December 31, 2013 to March 31, 2016.

Interestingly, Twitter completed it's initial public offering in November 2013 -- and every quarter thereafter, it reported a non-GAAP net income.

#83

Investment Ideas / Re: TWTR - Twitter Inc.

Last post by Dexter - May 12, 2016, 10:13:45 PMGlad you enjoyed it.

What I like about his approach to tech investing is the 3 step filter he uses in his investment selection process: 1) S-curve of technology adoption (future growth prospects), 2) companies with competitive advantages that will benefit from this future growth, and 3) valuation. Mr. Sacerdote has been able to use this approach with great success, it seems.

I also enjoyed his discussion of the role management plays in his investment selection. I don't think the quality of management can be overstated when it comes to tech companies. Things move way to fast, and you need someone at the helm that can act quickly, decisively and intelligently.

What I like about his approach to tech investing is the 3 step filter he uses in his investment selection process: 1) S-curve of technology adoption (future growth prospects), 2) companies with competitive advantages that will benefit from this future growth, and 3) valuation. Mr. Sacerdote has been able to use this approach with great success, it seems.

I also enjoyed his discussion of the role management plays in his investment selection. I don't think the quality of management can be overstated when it comes to tech companies. Things move way to fast, and you need someone at the helm that can act quickly, decisively and intelligently.

#84

Investment Ideas / Re: TWTR - Twitter Inc.

Last post by Mark P. - May 12, 2016, 09:02:23 PMMatt,

I got a chance to read Mr. Sacerdote's interview that focused on his process and analysis of investing in Tech stocks. I found it interesting when he was talking about Management teams as a an important investment criteria that he used a comparison of Mark Zuckerberg as a good CEO vs. Twitter's top executives as a poor management team.

Thanks for sharing. It is always interesting to see how expert investors invest in their target sector, and to pick up on any investment tips.

Thanks,

Mark P.

I got a chance to read Mr. Sacerdote's interview that focused on his process and analysis of investing in Tech stocks. I found it interesting when he was talking about Management teams as a an important investment criteria that he used a comparison of Mark Zuckerberg as a good CEO vs. Twitter's top executives as a poor management team.

Thanks for sharing. It is always interesting to see how expert investors invest in their target sector, and to pick up on any investment tips.

Thanks,

Mark P.

#85

Investment Ideas / Re: TWTR - Twitter Inc.

Last post by Dexter - May 11, 2016, 12:11:36 AMI wish you the best on your TWTR investment. I'll share any good potential investments with you and the rest of the forum members as I come across them.

I'm still working on my assessment of Twitter's business. In the meantime, I thought you might enjoy reading this interview with Alex Sacerdote of Whale Rock Capital.

https://www8.gsb.columbia.edu/valueinvesting/sites/valueinvesting/files/Graham%20%26%20Doddsville_Issue%2025.pdf

Alex's approach to investing in tech companies seemed really intelligent to me. Let me know what you think.

I'm still working on my assessment of Twitter's business. In the meantime, I thought you might enjoy reading this interview with Alex Sacerdote of Whale Rock Capital.

https://www8.gsb.columbia.edu/valueinvesting/sites/valueinvesting/files/Graham%20%26%20Doddsville_Issue%2025.pdf

Alex's approach to investing in tech companies seemed really intelligent to me. Let me know what you think.

#86

Investment Ideas / Re: TWTR - Twitter Inc.

Last post by Mark P. - May 10, 2016, 08:07:05 PMMatt,

Thanks for the quick response, and promise of a future assessment of TWTR's stock price/company valuation. There is also talk that Twitter could possibly be bought out by another larger company in the near future, and have new executive team put into place, which could also improve the company valuation. Regardless, I feel that the stock has bottomed out over the last few weeks, and I plan to buy at under $15/share and hold for the long-term.

If you have any other companies you are keeping an eye on or find that could be a good potential investment, please let me know.

Thanks,

Mark P.

Thanks for the quick response, and promise of a future assessment of TWTR's stock price/company valuation. There is also talk that Twitter could possibly be bought out by another larger company in the near future, and have new executive team put into place, which could also improve the company valuation. Regardless, I feel that the stock has bottomed out over the last few weeks, and I plan to buy at under $15/share and hold for the long-term.

If you have any other companies you are keeping an eye on or find that could be a good potential investment, please let me know.

Thanks,

Mark P.

#87

Investment Ideas / Re: TWTR - Twitter Inc.

Last post by Dexter - May 09, 2016, 11:58:16 PMHi Mark - Welcome to the Capital Alligator Forum! Glad to have you here.

Let me start off by saying that Twitter is not currently in my circle of competence. While the stock has certainly come down in price, I don't know if it's currently a good investment opportunity or not. Also, I have no idea what the stock might do over the next few weeks, so I can't comment on whether or not it would be a good pick over this time period (I try to maintain a longer time horizon in my investing).

With that being said, I'm going to dig into Twitter and give you my assessment of the business. It may take a few posts to do so, but stay tuned. I'll get back to you.

Let me start off by saying that Twitter is not currently in my circle of competence. While the stock has certainly come down in price, I don't know if it's currently a good investment opportunity or not. Also, I have no idea what the stock might do over the next few weeks, so I can't comment on whether or not it would be a good pick over this time period (I try to maintain a longer time horizon in my investing).

With that being said, I'm going to dig into Twitter and give you my assessment of the business. It may take a few posts to do so, but stay tuned. I'll get back to you.

#88

Investment Ideas / TWTR - Twitter Inc.

Last post by Mark P. - May 09, 2016, 12:30:26 AMCould Twitter (TWTR) be an interesting investment pick over the next few weeks? Here are some initial thoughts as to why I find this stock intriguing, and a potential opportunity.

-The CEO, Jack Dorsey, is currently running two publicly traded companies and splitting his time between the two companies, in addition to sitting on the Board for Disney. Could this be affecting the stock price of TWTR? I think so.

-Twitter's stock price recently hit it's lowest price this last week. Could it keep going down for the next few months? Yes, but in the long run, I believe Jack Dorsey will either take full rein over the company, or hand it over to another qualified executive of the company.

-After reading some of their quarterly earnings filing, it appears that twitter is simply not growing as fast as investors think it should, and hence the drop of the price. The financials are slowing getting better, although they are still losing money. In the next five to seven years there is no reason Twitter cannot grow 5 to 10 times larger than it currently sits today.

-Current market capitalization is roughly $10.1B with 310 million active monthly users. On the other hand Facebook has a market cap of $341B with 1.65 Billion users. Should Facebook really be valued at more than 30 times what twitter is valued at? My thought is no it shouldn't be. While Facebook is profitable, and seems to have a business that is working tremendously for them, there is no reason that Twitter cannot do the same thing, and capitalize on its large monthly user base.

-Overall I think this could be a good investment opportunity. Could Twitter be overtaken by another company, sort of how Myspace was overtaken by Facebook and replaced? Possibly, but I believe if Dorsey steps down, or devotes his time solely to Twitter this company could grow exponentially. I believe that while Twitter is finding out what works for them in this ramp up stage, it could be shaky, however I think the Execs will figure it out.

Any thoughts or insights would be appreciated. Happy Sunday.

http://www.profitconfidential.com/stock/twitter-inc-if-jack-dorsey-does-this-twitter-stock-could-skyrocket/

http://247wallst.com/technology-3/2016/05/07/square-and-twitter-need-to-dump-ceo-dorsey/

http://www.profitconfidential.com/stock/twtr-stock-why-twitter-inc-ceo-jack-dorsey-lost-340-million/

Mark

-The CEO, Jack Dorsey, is currently running two publicly traded companies and splitting his time between the two companies, in addition to sitting on the Board for Disney. Could this be affecting the stock price of TWTR? I think so.

-Twitter's stock price recently hit it's lowest price this last week. Could it keep going down for the next few months? Yes, but in the long run, I believe Jack Dorsey will either take full rein over the company, or hand it over to another qualified executive of the company.

-After reading some of their quarterly earnings filing, it appears that twitter is simply not growing as fast as investors think it should, and hence the drop of the price. The financials are slowing getting better, although they are still losing money. In the next five to seven years there is no reason Twitter cannot grow 5 to 10 times larger than it currently sits today.

-Current market capitalization is roughly $10.1B with 310 million active monthly users. On the other hand Facebook has a market cap of $341B with 1.65 Billion users. Should Facebook really be valued at more than 30 times what twitter is valued at? My thought is no it shouldn't be. While Facebook is profitable, and seems to have a business that is working tremendously for them, there is no reason that Twitter cannot do the same thing, and capitalize on its large monthly user base.

-Overall I think this could be a good investment opportunity. Could Twitter be overtaken by another company, sort of how Myspace was overtaken by Facebook and replaced? Possibly, but I believe if Dorsey steps down, or devotes his time solely to Twitter this company could grow exponentially. I believe that while Twitter is finding out what works for them in this ramp up stage, it could be shaky, however I think the Execs will figure it out.

Any thoughts or insights would be appreciated. Happy Sunday.

http://www.profitconfidential.com/stock/twitter-inc-if-jack-dorsey-does-this-twitter-stock-could-skyrocket/

http://247wallst.com/technology-3/2016/05/07/square-and-twitter-need-to-dump-ceo-dorsey/

http://www.profitconfidential.com/stock/twtr-stock-why-twitter-inc-ceo-jack-dorsey-lost-340-million/

Mark

#89

Events, Meetings & Notes / Markel Omaha Meeting Notes

Last post by Dexter - May 05, 2016, 12:21:22 AMHere are some notes from Phil Weiss on the 2016 Markel Omaha meeting:

https://www.dropbox.com/s/7gh3j9g02l398gp/Phil%20Weiss'%202016%20Markel%20Omaha%20Meeting%20Notes.pdf?dl=0

https://www.dropbox.com/s/7gh3j9g02l398gp/Phil%20Weiss'%202016%20Markel%20Omaha%20Meeting%20Notes.pdf?dl=0

#90

Investment Ideas / Re: BRK.A - Berkshire Hathaway...

Last post by Dexter - April 30, 2016, 07:49:12 PMThere doesn't seem to be any shortage of good analysis this year on Berkshire Hathaway. Below are a few more excellent resources:

1) This analysis by Semper Augustus Investments Group is one of the most detailed and thoughtful that I have ever come across. A true masterpiece.

PARTY LIKE IT'S NINETEEN NINETY-NINE: BAD BREADTH, INTRINSIC VALUE, AND A DEEP DIVE INTO BERKSHIRE HATHAWAY

2) A follow-up interview with Chis Bloomstran of Semper Augustus on his impressive 70 page analysis of Berkshire Hathaway:

Berkshire Believer: Stock's Slide, Change in Buffett Valuation Guide Don't Temper Ardor

3) A great discussion by Losch Management on the sources and uses of cash & operating earnings at Berkshire.

Operating Earnings

1) This analysis by Semper Augustus Investments Group is one of the most detailed and thoughtful that I have ever come across. A true masterpiece.

PARTY LIKE IT'S NINETEEN NINETY-NINE: BAD BREADTH, INTRINSIC VALUE, AND A DEEP DIVE INTO BERKSHIRE HATHAWAY

2) A follow-up interview with Chis Bloomstran of Semper Augustus on his impressive 70 page analysis of Berkshire Hathaway:

Berkshire Believer: Stock's Slide, Change in Buffett Valuation Guide Don't Temper Ardor

3) A great discussion by Losch Management on the sources and uses of cash & operating earnings at Berkshire.

Operating Earnings